But no! These geniuses did not want to do the work. All we needed was four pieces of information (beneficiary for an account set up) that would have taken a person of average intelligence less than 2 minutes to note on a piece of paper or a printout. Mina said she had an appointment in 10 minutes. When asked, they both didn't want to help. In this particular case, their manager Lorenzo Mata and business correspondent Mina Shah were just sitting there. No one steps up to talk to you or serve your needs. Every time you walk into the branch, people are twiddling their thumbs. I wish there was a way to give to zero rating here. All we needed was four pieces of information (beneficiary for an account set up) that Sign up for priority access at and lock your rates for the year.I wish there was a way to give to zero rating here.

We’re working tirelessly to ensure this reality. Your money should work for you 24/7 at no added cost. No more anxiety of switching between checking and savings accounts. OnJuno’s FDIC insured High Yield Checking Account can help you earn an industry-leading 1.20% on all deposits. Need a bank account without the fees or the anxiety? We're here to help This is why it is essential that you clear all bank dues prior to closing your account. Banks will pass on the overdue amount to collection agencies, who can report to credit bureaus, thus affecting your credit score.

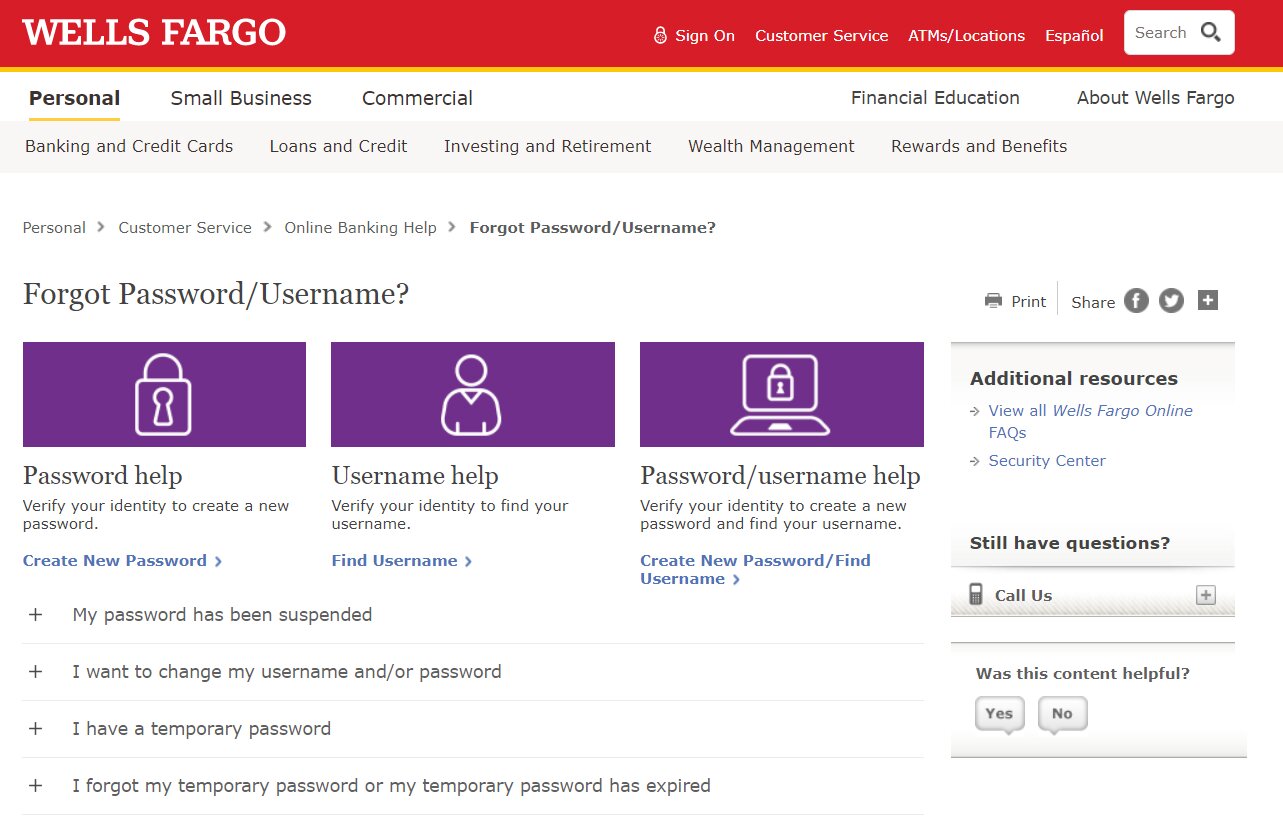

The only case where your credit score might be affected is if you have negative overdraft balance and haven't repaid in a long time. No, it doesn't! Credit bureaus are not privy to your bank account information and hence cannot report your transactional activity to the credit bureau. Does Closing a Bank Account Affect Credit Score? If you don't have access to a local branch, call the Wells Fargo support center at 1-80 and request for account closure.You can find the closest branch to you on this online locator. You will need to provide identity proof, so carry along your social security number, valid ID, address details, pin numbers etc. Visit your local Wells Fargo branch and speak to an account executive.If you've maintained zero balance, you should receive a confirmation email within a few days. The easiest way to close your account is to log onto the Wells Fargo online banking website, head to the Contact Us section, where you can send an email requesting account closure.You deserve it.Ĭlosing a Wells Fargo Checking or Savings Account Transfer any remaining balances over to your new account and go make that evening margarita.This is essential to protect your credit score (explained later). Check for any recurring or overdue bank fees and resolve them.

#Sign on wells fargo online banking full

This is clearly not the case when you bank with America’s most illustrious financial institutions. And to add insult to injury, an interest rate that hovers between 0 and 0.01% making you effectively zero income on your precious deposits.Įver heard the phrase, “your money should generate returns as you sleep"?.

#Sign on wells fargo online banking free

By this point, you’ve probably realized that their rosy promises of free checking accounts and high-yield savings accounts were just leading you into a labyrinth of hidden fees and charges. So you’ve made the decision to close your Wells Fargo account.

0 kommentar(er)

0 kommentar(er)